CRISIL has downgraded its ratings on the bank facilities of Pratibha Industries (PIL; a part of the Pratibha Industries group) to 'CRISIL BB+/Negative/ CRISIL A4+' from 'CRISIL BBB/Negative/CRISIL A3+.

The rating downgrade reflects the expectation of continuing pressure on the Pratibha Industries group's financial risk profile, even after taking into account the group's deleveraging plans in the near to medium term. The group's financial risk profile is marked by substantially high gearing and modest debt protection metrics.

The rating downgrade reflects the expectation of continuing pressure on the Pratibha Industries group's financial risk profile, even after taking into account the group's deleveraging plans in the near to medium term. The group's financial risk profile is marked by substantially high gearing and modest debt protection metrics.

The Pratibha Industries group's gearing increased to 2.97 times as on March 31, 2014 from 2.14 times as on March 31, 2012. The group has completed sale of saw pipe division in current financial year. The group also plans to improve its capital structure through sale of other non-core assets as well as raising equity through qualified institutional placement; the success of this plan will hinge on the extent of improvement in the external environment.

CRISIL believes that the improvement in the group's capital structure will be gradual, given its large working capital requirements; and hence the group's gearing and debt protection metrics will remain modest in the near to medium term.

The Pratibha Industries group's working capital cycle continues to remain stretched; mainly driven by a substantial increase in its inventory. The inventory levels are expected to reduce gradually with the completion of few major projects in current financial year. However, the working capital requirements are expected to remain high owing to the new orders execution that will be undertaken by the company.

The Pratibha Industries group also undertook a capex of over Rs 2 billion in 2013-14, for purchase of tunnel-boring machines (TBMs), which was largely debt-funded. The purchase of TBMs will help the company in garnering and executing other similar orders going forward. Hence, CRISIL believes that there will be no major capex requirement in the near term, given the group's focus on orders in the water segment.

The ratings continue to reflect the Pratibha Industries group's revenue growth with a sustained operating margin. Furthermore, the company continues to have a sizeable order book, with increasing focus on orders in the water segment. These rating strengths are partially offset by the group's deteriorating financial risk profile, with high gearing and modest debt protection metrics as well as working-capital-intensive operations.

CRISIL believes that the Pratibha Industries group's gearing will remain high in the near term because of its sizeable working capital requirements, despite improvement in capital structure with the stated plans. The rating may be further downgraded in case of a continued stretch in the group's working capital cycle, lower-than-expected operating performance or higher-than-expected gearing.

Conversely, the outlook may be revised to 'Stable' if the group's working capital management improves, or in case of substantial equity infusion, thus strengthening its capital structure.

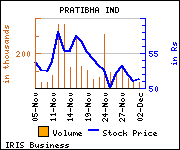

Shares of the company declined Rs 2.7, or 5.27%, to trade at Rs 48.55. The total volume of shares traded was 275,721 at the BSE (10.47 a.m., Wednesday).